Basic settings for calculating Minority Interests

Table of contents

1 Business Background

If the group?s share of an interest in a group company is less than 100% then the

minority interests have to be shown separately for the capital consolidation. For

the technical implementation of the calculation of minority interests, IDL.KONSIS

uses the step consolidation technique and operates in accordance with a group share

calculation concept where the technical implementation differs slightly from the

traditional group share method. This was a deliberate choice in order to be able

to obtain greater transparency in terms of the strands of participation and to verify

these.

Under the traditional group share method, the own share of interests and the minority

interests are calculated from the perspective of the ultimate parent company; however,

in IDL.KONSIS, first of all, the shareholdings between the parent company and the

subsidiary are calculated (additive percentage rate) and - provided that the parent

company is not 100% owned by the group companies - calculates the indirect shareholding

that results from this (multiple percentage rate). This means that there is a two-step

calculation for minority interests. 1st step: Calculation of direct minority interests

(100 minus the additive percentage rate), 2nd step: Calculation of indirect minority

interests that still only represent the difference between the direct minority interests

and those minority interests calculated from the group share. In IDL.KONSIS this

is visualised via the voucher structure. This means that the direct minority interests

vouchers plus the indirect minority interests vouchers produce the minority interests

from the perspective of the ultimate parent (group share).

In IDL.KONSIS the technical processing of minority interests proceeds in 2 steps:

1st step: at first consolidation, processing of the direct minority interests on the capital

on the basis of the historical exchange rate (in an FK voucher)

2nd step: using the "Update Minority Interest" function, calculation of currency conversion

effects on the capital and direct minority interests on the current net income for

the year and, potentially, on current changes (in an FF voucher with a GES).

3rd step:(runs automatically in parallel when the second step is being executed): Calculation

of the indirect minority interests on the currency conversion effects of the capital,

on the current net income for the year and, where there is goodwill attributable

to minorities, an adjustment of the goodwill that has arisen at the parent company

by the direct share at the parent company (in an FF voucher with two companies).

2 Pre-requisites for Automatic Processing

The following processing steps have to be executed in IDL Konsis in order to achieve the automatic calculation of minority interests:

--> Setting up the consolidation parameter 'FK'

--> Updating the shareholding and the capital transactions

2.1 Setting up the consolidation parameter 'FK'

To begin with, the consolidation parameter 'FK' must be created in the 'Consolidation

Parameters' (KTKPAR) application, without which this function cannot be used. If

this function is used for the first time then, in the selection area in the field

'Consolidation Function', it is necessary to select the function abbreviation 'FK'

from the selection list shown there and to have it displayed. The overview will initially

remain empty. An individual record display will open above the star symbol in the

menu bar and you will be able to create the data.

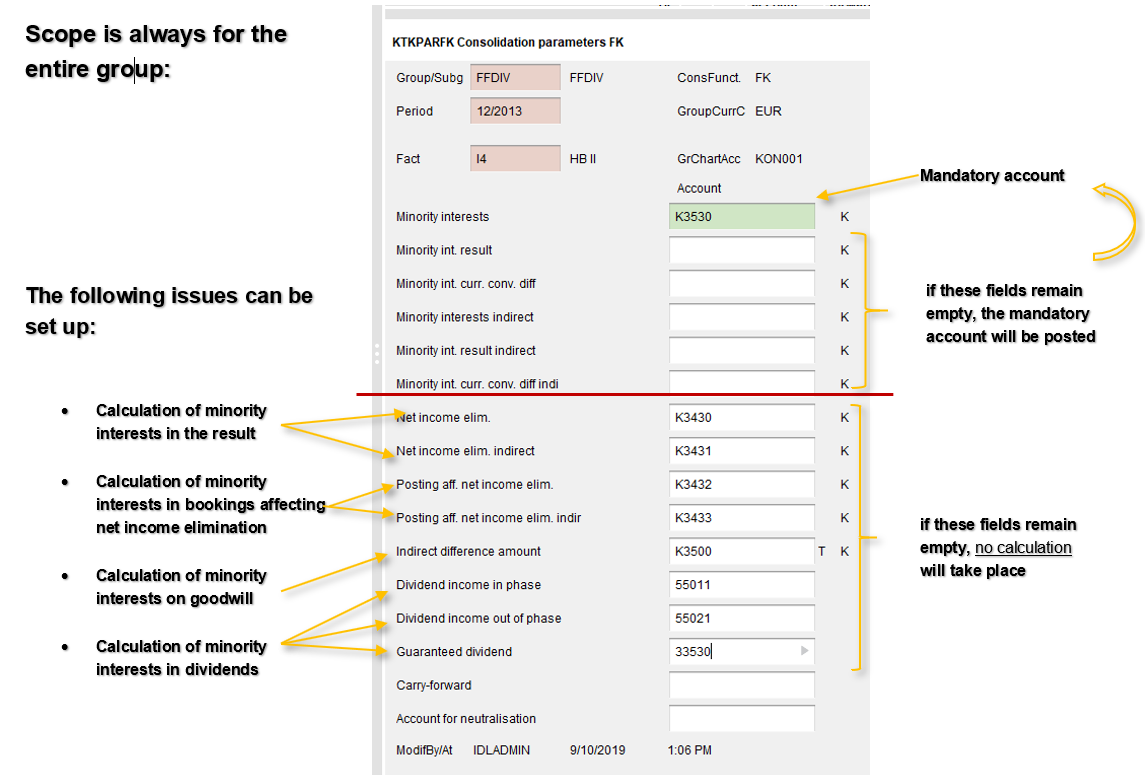

Various accounts can be defined in the consolidation parameter that will then be

used for automatic processing. The entries serve the purpose of, firstly, differentiating

the posting of the adjustment items to minority interests as well as providing the

option of executing very different actions within the automatic calculation of minority

interests. What is important, however, is that one account has to entered at least

into the mandatory account (colour highlighted field) because, without this entry,

no calculation of minority interests will be performed.

Therefore, the entries in the consolidation parameter 'FK' for the calculation of

minority interests can be divided into 2 groups:

- Fields for minority interests accounts (if these remain empty then the posting will

always be made to the mandatory account)

- Fields for elimination accounts or other situations (if these fields remain empty

then no calculation will take place)

Image: Consolidation parameter FK

Significance of the individual fields in the parameter:

-

[minority interests]:

- mandatory entry. This account is used for the posting when minority interests are

calculated. If no further differentiation via entries in the following fields (for

minority interests in profit or loss and in the currency conversion effects) has

taken place then all minority interests issues will be posted to this account. If

no account has been entered then the FK parameter will not be created and minority

interests will not be calculated. You are only allowed to enter a liability account

here (BG account flag = 2).

-

[minority interests in profit or loss]:

- optional entry. When an account is entered in this field the direct minority interests

in profit and loss will be posted to this account. If no account has been entered

then the posting will be made to the 'Minority Interests' account. You are only allowed

to enter a liability account here (BG account flag = 2).

-

[minority interests in currency conversion effects]:

- optional entry. When an account is entered in this field the minority interests in

the currency conversion effects will be posted to this account. If no account has

been entered then the posting will be made to the 'Minority Interests' account. You

are only allowed to enter a liability account here (BG account flag = 2).

-

[indirect minority interests]:

- optional entry. When an account is entered in this field then all the indirect minority

interests that have been calculated (currency conversion effects from capital and,

if no separate 'Indirect Minority Interests Profit or Loss' account has been provided,

likewise from net income for the year) are posted to this account. If no account

has been entered then, as previously, the posting will only be made to the 'Minority

Interests' mandatory account. You are only allowed to enter a liability account here

(BG account flag = 2).

-

[indirect minority interests in profit or loss]:

- optional entry. When an account is entered in this field the indirect minority interests

in profit and loss will be posted to this account. If no account has been entered

then the posting will be made to the 'Indirect Minority Interests' account. You are

only allowed to enter a liability account here (BG account flag = 2).

-

[indirect minority interests in currency conversion effect]:

- optional entry. When an account is entered in this field the indirect minority interests

in the currency conversion effects will be posted to this account. If no account

has been entered then the posting will be made to the 'Indirect Minority Interests'

account. You are only allowed to enter a liability account here (BG account flag

= 2).

-

[elimination net Income for the year]:

-

optional entry: When an account is entered in this field the minority interests in

the profit or loss on the P/L side will be eliminated from this account. The account

can be both a balance sheet account (BG account flag=2) as well as a P/L account

(BG account flag 3/4). If the account is a balance sheet account that is flagged

'Reposting Carry- Forward' then the carry-forward posting takes place from this account

to the carry-forward account that has been defined either in the account master,

or with the account flag 1=X. If the account is a P/L account then the minority interests

in the net income for the year on the P/L side will be posted to this account and

thus affect net income. The carry-forward posting then takes place from the 'Net

Income for the Year' account [account flag=E] against the carry-forward account flagged

with an 'X' or the carry-forward account that has been entered in the FAC. If, here, NO account has been entered then the minority interests in the net income for the year

will NOT be calculated. This will then apply to all companies in the group or sub-group for which this consolidation parameter 'FK' has

been created.

-

[elimination net income for the year, indirect]:

-

optional entry: Use is analogous to the use of the 'Elimination Net Income for the

Year' account, only here for the indirect share of the profit or loss. If, here, NO account has been entered then the indirect minority interests in the net income for

the year will NOT be calculated. This will then apply to all companies in the group or sub-group for which this consolidation parameter 'FK' has

been created.

-

[elimination of income-affecting consolidation postings]:

-

optional entry: When an account is entered in this field the minority interests in

the previously flagged net income-affecting consolidation postings will be posted

to this account. The account can be both a balance sheet account (BG account flag=2)

as well as a P/L account (BG account flag 3/4). If the account is a balance sheet

account that is flagged 'Reposting Carry-Forward' then the minority interests in

the net income-affecting consolidation posting on the P/L side will be posted to

this account. The carry-forward posting then takes place from this account to the

carry-forward account that has been defined either in the account master, or with

the account flag 1=X. If the account is a P/L account then the minority interests

in the net income-affecting consolidation posting on the P/L side will likewise be

posted to this account. However, the carry-forward posting then takes place from

the 'Net Income for the Year' account [account flag=E] against the carry-forward

account flagged with an 'X' or the carry-forward account that has been entered in

the FAC. If NO account has been entered here then the minority interests in the net income-affecting

consolidation posting will NOT be calculated.. This will then apply to all companies in the group or sub-group for which this consolidation parameter 'FK' has

been created.

-

[elimination of income-affecting consolidation postings, indirect]:

-

optional entry: Use is analogous to the use of 'Elimination of Net Income-Affecting

Postings' account, only here for the indirect share of the net income-affecting consolidation

posting. If NO account has been entered here then the minority interests in the net income

for the year will NOT be calculated. This will then apply to all companies in the group or sub-group for which this consolidation parameter 'FK' has

been created.

-

[indirect difference amount]:

-

optional entry: This account is a suspense account to which the indirect share of

the calculated difference amount (from the first consolidation) can be posted. The

amount that has been calculated and posted to this account will be automatically

distributed using the 'Minority Interest Updating' (FF) function analogous to the

posting in capital consolidation (KK). If NO account is entered then, despite the execution of the calculation of minority

interests, no indirect minority interests in the difference amount will be calculated.You are only allowed to enter an asset account or a liability account here (BG flag

= 1 or 2) with the account flag 'T'.

-

[dividend income/same period or different period]:

-

optional entry: When a profit account is entered in this field and, at the same time,

this account is used for the posting of dividend income at the parent company (IC

details required) then the system calculates the minority interests in the dividend

income posting at the parent company and, thereafter, assigns the minority interests

to the minority interests account specified in the parameter. If NO account is entered here then no minority interests in the dividends will be

calculated.. This will then apply to all companies in the group or sub-group for which this consolidation parameter 'FK' has

been created. You are only allowed to enter a profit account (BG flag 3) that is

simultaneously an 'I' account and has been assigned to the consolidation function

'SK' (same period) or 'SD' (different period).

-

[guaranteed dividend]:

-

optional entry: in the event that the minority interests in the annual profit or

loss have been stipulated in a contract as a fixed amount (guaranteed dividend) then,

by entering an account, this can be controlled here so that precisely this amount

is included in the minority interests calculation. If NO account is entered here then, despite the execution of the minority interests

calculation, no guaranteed dividend will be calculated. This will then apply to all companies in the group or sub-group for which this consolidation parameter 'FK' has

been created. You are only allowed to enter an asset account or a liability account

here (BG flag =1 or 2).

-

[retained earnings]:

- you have the option of entering a retained earnings account (BG flag =2) to which

the net income-affecting share of the consolidation posting for the preceding accounting

period would be carried forward. We recommend using a group retained earnings account

that differs from the company financial statements and the HBII financial accounts.

If no account is entered here then the carry forward-posting will be made to the

retained earnings account that has been defined in the consolidation parameter 'KK'.

-

[neutralisation]:

- you have the option of entering a neutralisation account (account flag=N). When you

enter an account, additional postings to the neutralisation account will be automatically

generated in the related consolidation vouchers. These postings neutralise shifts

in the balance sheet and P/L profits or losses between the two companies mentioned

in the voucher. By including the neutralisation postings in the group report it is

possible to precisely match the company details of the profit or loss with the company

financial statements.

-

-

Meaning of the indicator of the field 'indirect minority interests on exchange rate

effects on all balance sheet accounts'

- Usually, indirect minority interests are calculated on the exchange rate effects

of the capital accounts. However, if indirect minority interests are also to be calculated

on the exchange rate effects of the investment accounts and asset accounts, this

can be controlled by entering an 'X' in this field. This then applies to all companies

in the group.

2.2 Update of the Shareholding and the Capital Transaction

In order to correctly calculate the minority interests it is important for the shareholding

transactions to match the capital transactions. The following entries affect the

correct calculation of minority interests:

-

the transaction date: the transaction date in the shareholding transactions and in the capital transactions, for each situation that has to be processed, must be the same . If the transaction data differ from one another then either an erroneous calculation

or no calculation will take place. A strict audit of the transaction data is necessary

in order, for example, to enable a correct capital consolidation even for a successive

acquisition of a shareholding.

-

The Posting Key Usage Tag: the posting key usage tag: for the shareholding transaction and capital transaction, for each situation that has to be processed, must be the same . If the posting key usage tags differ from one another then either an erroneous

calculation or no calculation will take place. This concerns, in particular, the

posting key usage tags B02 (addition of a participation) and B08 (capital increase)

3 Triggering the Calculation of Direct Minority Interests

3.1 First step: Minority interests consolidation within capital consolidation (KK)

The first step involves the calculation of the minority interests in the capital accounts. This happens as part of the capital consolidation (KK). When executing the action 'Automatic First Consolidation'/ 'Form Entry for Capital

Consolidation' the own share of interests as well as the minority interests in the

capital are posted. The own share of interests in the capital is posted in a KK voucher

and the minority interests in the capital are posted in an FK voucher. The minority

interests voucher includes the company number of the subsidiary and the voucher abbreviation 'FK' (Subsidiary__FK).

3.2 Second step: Update Minority Interests (FF)

The second step involves updating minority interests. The function 'FF' (update minority interests)can be found in group companies + monitor under the action 'Update Minority Interests'

- 'Post Update of Minority Interests'

Within the ?Post Update of Minority Interests? function, the following calculations

are executed for the 'direct minority interests' and generated in one voucher that

has the company number of the subsidiary and the voucher abbreviation 'FF' [Subsidiary__FF]:

- Calculation of the direct minority interests in the currency conversion effects (in

the following period always only the difference in relation to the previous period)

- Calculation of the direct minority interests in the net income for the year

- Calculation of the direct minority interests in income-affecting consolidation postings

(optional)

4 Triggering the Calculation of Indirect Minority Interests

The direct minority interests are derived from the participation relationship between

the parent company and the subsidiary, however, the indirect minority interests are

presented on the basis of the participation relationship from the perspective of the ultimate parent company(Grandparent company - Parent company - Subsidiary). In IDL.KONSIS, the indirect

minority interests that have to be posted result from the difference between the

additive and the multiplicative participation percentage rates from the group companies

+ monitor. The indirect minority interests are automatically posted when the 'Update Minority Interests' action is triggered

in the group companies + monitor.

The following situations will thus be taken into account for the indirect minority

interests calculation:

- Indirect minority interests in the net income for the year

- Indirect minority interests in the currency conversion effects for net income for

the year

- Indirect minority interests in the currency conversion effects for the capital (in

the following period always only the difference in relation to the previous period)

- Indirect minority interests in the income-affecting consolidation postings (optional)

- Indirect minority interests in the difference amount from the first consolidation

in the direct relationship between the grandparent company and the parent company

in the group.

Note on the Difference Amount: The minority interests in the difference amount are automatically posted within

the 'FF' function (update minority interests) against the offsetting account posted

in the first consolidation. Additional distribution via the 'VUB' would thus only

be necessary if the posting of the difference amount had not yet happened in the

first consolidation. You can disable the calculation of minority interests in goodwill by removing the

offsetting account specified for this in the consolidation parameter FK. This will

then apply to all the companies in the group/sub-group.

5 Postings in a Multi-Level Group

To enable the automatic calculation of minority interests for a multi-level group,

too, the 'Update Minority Interests' action must be newly triggered for each group

level. Here, the system cancels the minority interests vouchers of the underlying

sub-group (posting text 'Cancel Group/TK: NAME_TK') within the new voucher (in the

posting record number 10) and re-calculates the minority interests on the basis of

the current level.

The 'Update Minority Interests' action then also has to be triggered once again if

there are no more minority interests on a higher level. This is because it is only

by triggering the 'Update Minority Interests' action that the minority interests

vouchers in the level below are cancelled.

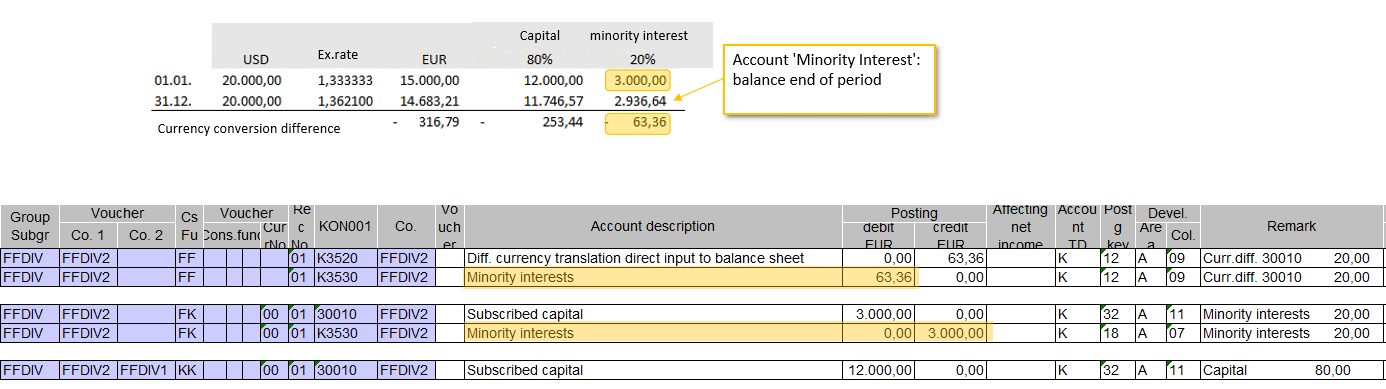

6 How are the currency conversion differences calculated?

In an FK voucher the pro-rata amount for minority interests, per capital account, is posted against

the minority interests account that has been entered in the consolidation parameter

'FK' (or defined in the account master of the capital account). This is done at the

exchange rate at which the capital was converted (normally at the historic exchange

rate). Since the minority interests are always posted at the closing rate, the currency

conversion differences arising from the different exchange rates (historic rate vs.

closing rate) have to be calculated and posted. This is done within the 'Post Update

of Minority Interests' (FF) action and is documented in the FF voucher . In the FF voucher the pro-rata currency conversion effect (historic value vs. closing

rate) is calculated for each balance sheet account. The amount is posted against

the "Cumulative Conversion Differences Balance Sheet" account in the currency conversion

header record for the company.

The total for each account from the postings of the FK and FF vouchers thus results

in the converted value at the closing rate that is posted to the 'Minority Interests

Adjustment Items' account.For the verification of the individual currency effects for each account it is recommended

to make a comparison with the account currency conversion statement in the KTOUMR

application. The minority interests function calculates the currency conversion effects

for each account from this overview.

Sample calculationfor the "Subscribed Capital" capital account for a company that reports in USD:

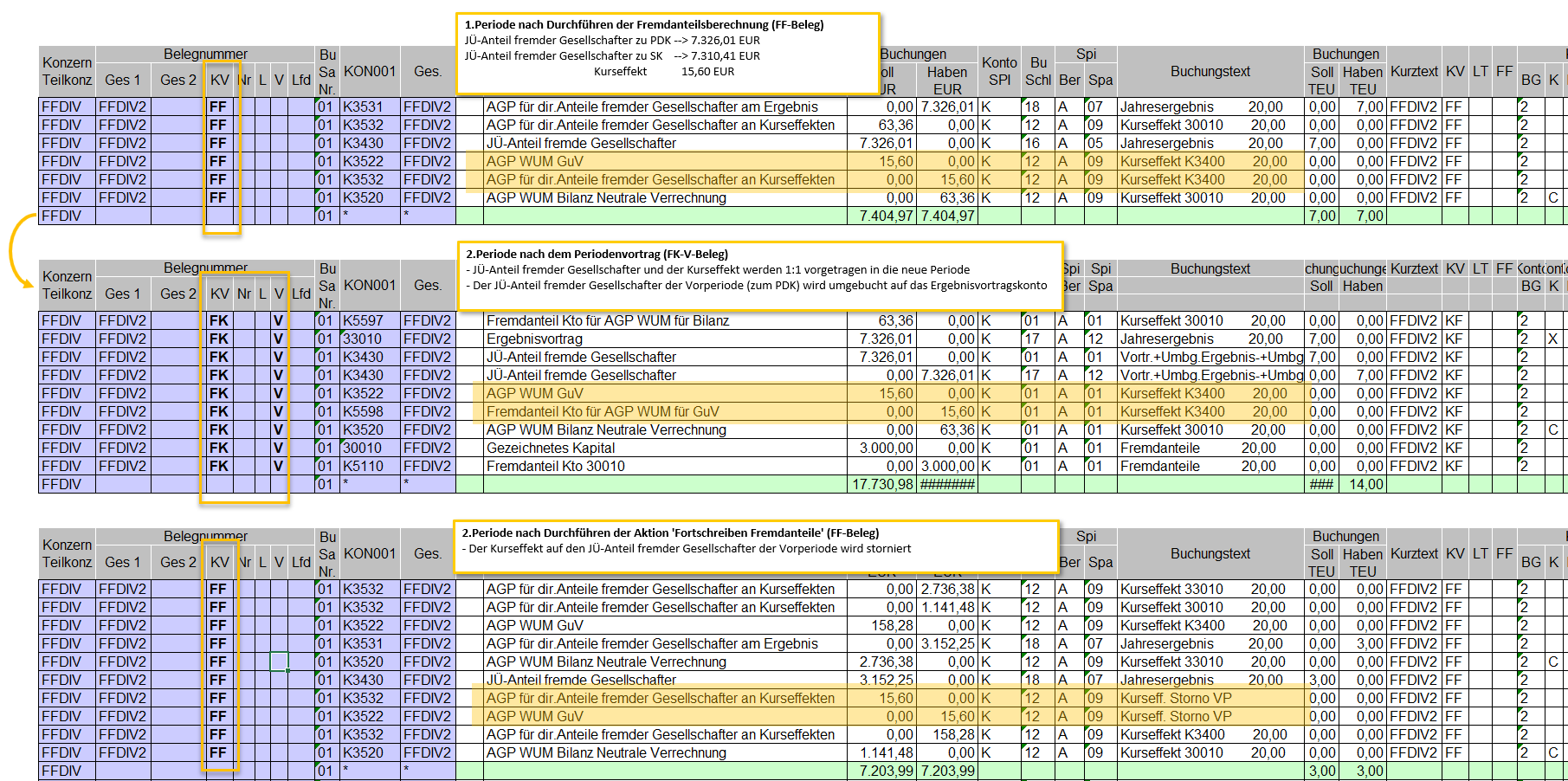

What happens in the next period?

The period carry-forward function produces a carry forward voucher (FK__V voucher) on the basis of the balance arising from the FK voucher and the FF voucher from

the previous period. Balances are generated for each posting key and account. This

means that capital values for each account and the net income for the year as well

as circumstances related to currency conversion effects are carried forward individually

in each case.

While the values in the capital accounts and their currency conversion effects continue

to be updated, the situation with respect to the JÜ share attributable to external

shareholders and the currency conversion effects on it is somewhat different.

The JÜ share attributable to external shareholders and the currency conversion effects

on it are initially carried forward on a 1:1 basis. The JÜ share attributable to

external shareholders (PDK value) is reposted in a carry-forward voucher to the retained

earnings account. The balance of the retained earnings account, like all other capital

accounts, will continue to be carried forward at the updated average exchange rate

(FDK) and the new currency conversion effect arising thereafter will be calculated

(FDK vs. SK). The pro-rata currency conversion effect on the JÜ share attributable

to external shareholders from the previous year is cancelled in a new FF voucher

after the execution of the 'Update Minority Interests' function [posting text: 'Currency

Conversion Effect STO VP'].